Salary Based Health Insurance Premiums

Meaning that employees who earn less pay lower insurance premiums. Where you live has a big effect on your premiums.

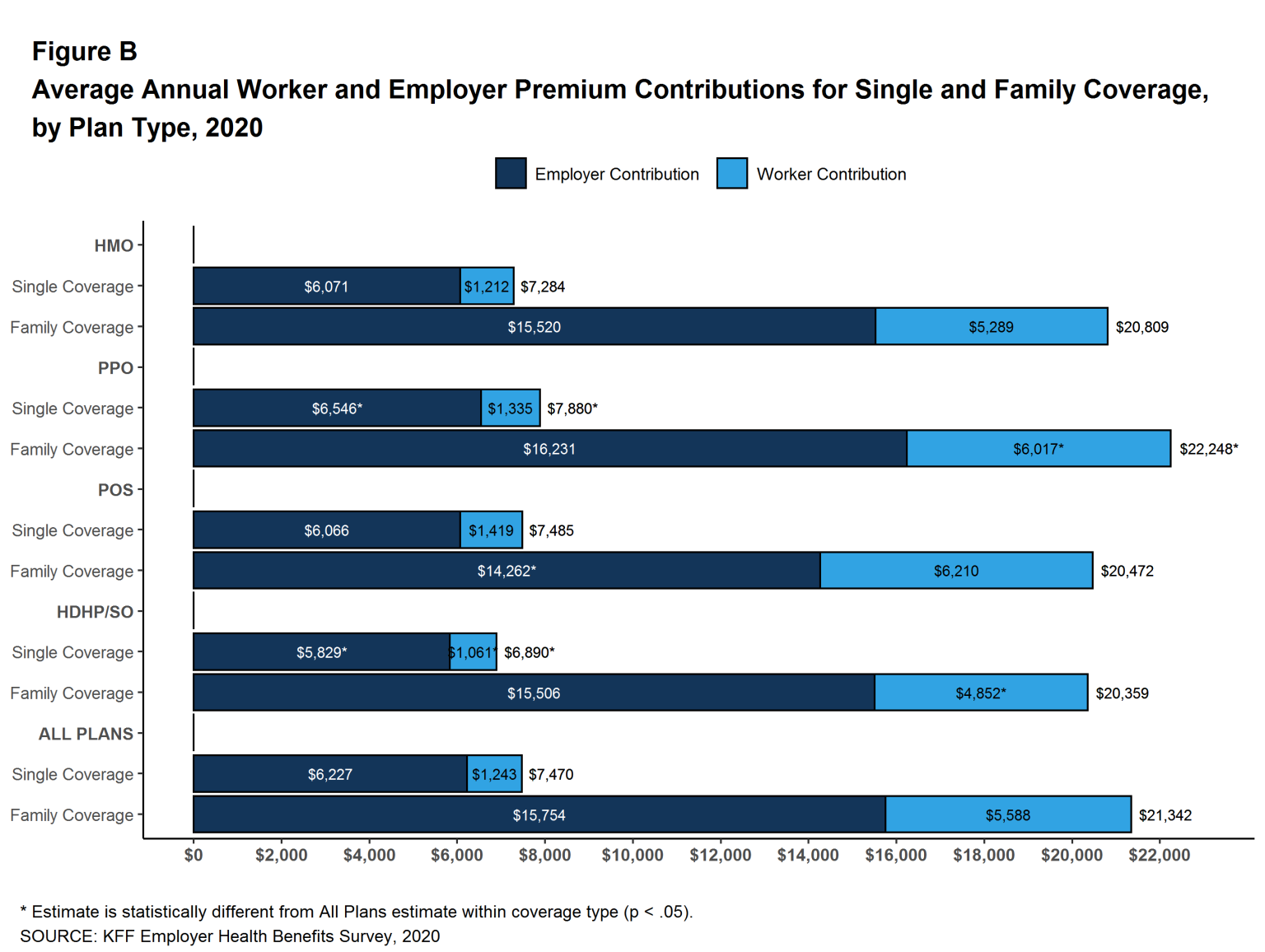

How Much Does Group Health Insurance Cost

Several companies like GE and Pitney Bowes have based insurance premiums on.

Salary based health insurance premiums. Ease the cost of private health insurance by salary packaging the premiums. Ad Join Direct By May 31 Well Waive Any 2 6 Month Waits On Extras Plus Get 1 Month Free. Salary-based Health Insurance Premiums Employee health insurance premiums at most companies differ only by family size and type of plan for example deductible amount.

Employee health insurance premiums at most companies differ only by family size and type of plan for example deductible amount. However as a result of the Affordable Care Act some employers are looking to base health insurance premiums off of an employees salary instead in an effort to make coverage more affordable for lower-wage earners. You can probably start with your households adjusted gross income and update it for expected changes.

Quotes are based on a 28 or 30 day waiting period and benefit period of 2 years. This Salary Based Health Insurance. Meaning that employees who earn less pay lower insurance premiums.

Hourly employees pay 245 percent of the premium on average while salaried employees pay an average of 35 percent says Proestakes. For 2020 you qualify for tax credits to lower your monthly premiums if you are single and earn between 12490 to 49960 or you are in a family of three earning between 21330 to 85320. When you package this item Smartsalary will after the end of the FBT year 31 March deduct an additional pre-tax amount equivalent to the amount you are packaging multiplied by 8868 to offset the FBT.

Eligible employees could salary package their insurance premiums potentially saving them money to spend on other things. Under the health care law insurance companies can account for only 5 things when setting premiums. Monthly benefit amounts of 3125 and 6250 are based on 75 of monthly income for an annual income of 50000 and 100000 respectively.

How premiums are set. When you package this item Smartsalary will after the end of the FBT year 31 March deduct an additional pre-tax amount equivalent to the amount you are packaging multiplied by 8868 to offset the FBT. At most companies insurance premiums vary only by the type of plan selected and family size.

To use pre-tax dollars to pay for your health insurance and reduce your taxable income why not salary package your premium. The table below details the different rebate amounts and Medicare Levy Surcharge levels. At some companies though another factor is taken into accountsalary.

For New Joins Any Hospital Extras After Their First 60 Days. Differences in competition state and local rules and cost of living account for this. Salary-based health insurance premiums could gain ground in the coming years as the federal health care reform law is implemented.

Premiums can be up to 3 times higher for older people than for younger ones. We often hear about the importance of private health insurance as the cost of an unexpected medical expense can be significant. The private health insurance rebate is income tested.

In addition you qualify for cost-sharing subsidies if you are single making up to 31225 or in a family of three earning up to 53325. Health insurance premiums attract fringe benefits tax FBT at the full rate. Salary-based Health Insurance Premiums.

Most Australians with private health insurance currently receive a rebate from the Australian Government to help cover the cost of their premiums. The firms health benefits data covering 1600 employers found that 21 percent set health insurance premium amounts based on employee pay levels. We often hear about the importance of private health insurance as the cost of an unexpected medical expense can often be significant.

Health insurance premiums attract fringe benefits tax FBT at the full rate. Ease the cost of private health insurance by salary packaging the premiums. At some companies though another factor is taken into accountsalary.

Smartsalary recommends that you do not salary package this item. Savings are based on your income estimate for the year you want coverage not last yearsUse our income calculator to. Several companies like GE and Pitney Bowes have based insurance premiums on.

In one GE option a worker making less than 25000. Compare Direct Income Protection. Estimating your expected household income for 2021.

How Much Does Individual Health Insurance Cost Ehealth

Graph Of Everything That S Wrong With Health Insurance Premiums

Study Workers Health Care Costs Are Surging While Their Wages Stagnate Thinkprogress Family Health Insurance Infographic Health Health Insurance

Why U S Health Care Is Obscenely Expensive In 12 Charts Healthcare Costs Health Care Health Care Insurance