Can I Add My Parents To My Health Insurance Kaiser

In most cases adding a spouse to your health insurance. Take a look at some of the ways we can help you feel and be your best.

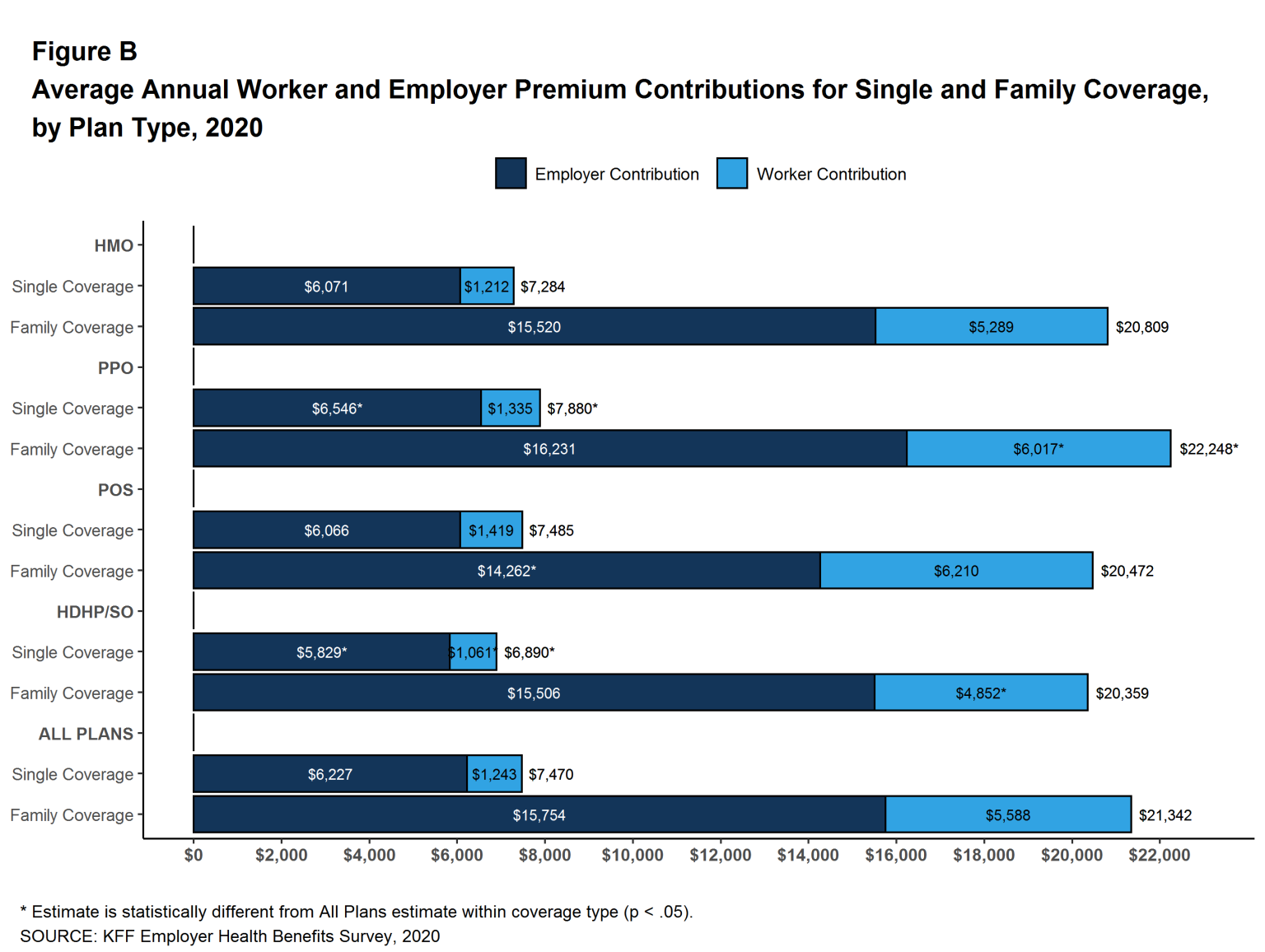

How Much Does Group Health Insurance Cost

By enrolling your child in Kaiser Permanente Child Health Plan you can ensure that your child receives the health care he or she needs to thrive.

Can i add my parents to my health insurance kaiser. If you have questions about joining Kaiser Permanente give us a call at 1-800. Adding your spouse as a dependent. Its wherever you feel like your best self.

There are some insurance companies that will allow you to add a parent as a dependent to your health plan. For example Bank of America permits it as long as the parents are under 65 live with the employee and. Pick the right health coverage for you.

Nourishing your body mind and spirit. Its unlikely youll be able to do so. If you have coverage in your own name when you turn 26 it wont be affected.

This is the time to explore your options for a Kaiser Permanente plan of your own. Where do you feel your healthiest. With Kaiser Permanente you choose your own primary care doctor so you have a health care provider whos dedicated to your personal health.

The VA for example will permit you to add a parent to your health plan as long as the parent meets the proper income qualifications. According to Healthcaregov the website for the Health Insurance Marketplace dependent parents can be included in your household as long as you already claim your parents as tax. But coverage is not required to be offered to grandchildren.

Some plans may but theyre in the minority. Ad You can compare over 600 health policies from over 20 different funds online now. Eligible for employer-based coverage.

Gisonny says that health plans typically limit the definition of dependents to a spouse and children. Healthy isnt just found in gyms and yoga studios. You can add your child to your plan even if you dont claim them as a tax dependent.

At present many funds allow certain young adults such as single students to remain on their. Tax-free in this case means that you dont pay income tax on the employer share of the premiums and your share of the premiums is deducted from your check pre-tax. Adding a Parent to Your Policy If your health insurer allows parents as dependents youre in luck.

Your employer can provide tax-free health insurance to you your spouse and your dependents. Learn about our plans Kaiser Permanente offers a variety of plans for companies that supply health insurance to their employees. You want health care for you and your family that you can rely on.

However if your parents are covered under a group health plan offered by a large employer 50 or more workers then your parents plan is only required to cover your prenatal care but is not. As long as your children meet these other requirements you can usually still include them in your coverage. In the Budget announcement last month Treasurer Josh Frydenberg said that from 1 April 2021 health insurers would be allowed to increase the age that dependants can stay on a family policy from age 24 to age 31 to encourage continuity of cover.

Ad We Compare 100s of Policies to Get You a Great Deal. You can still add your child to your health plan even if they chose to not enroll in their employers health insurance plan. Although the practice is not common some employers will allow employees to add their parents to their health insurance policies as dependents.

We can help you find your healthy place with care and coverage designed to help you thrive. Well-being to academic performance. Its about being heard by a doctor who knows you.

Lower income parents who have health insurance through their employers are increasingly likely to forgo family coverage and enroll their kids in Medicaid or the Childrens Health Insurance. And helping you take an active role in your health care. See if you can find what youre looking for by comparing policy fees extras more.

Can my parents discontinue my coverage before I turn 26. He adds that theres no mandate under federal law that an employer health plan must cover an employees parents. However its still worth asking your employer if you can add your grandchild to your plan says Cheryl Fish-Parcham.

Ad We Compare 100s of Policies to Get You a Great Deal. Can my boyfriend or girlfriends child be added to my health plan. But if youre a dependent on a family plan you may lose coverage under that plan.

And they may require that youve already listed your parent as a dependent on your taxes. The health law requires insurers and employers that cover dependents to make coverage available until children reach age 26. A small minority of insurance companies do allow parents to be added to plans.

Depending on your family size and income your monthly premium may be just 8.

10 Best Health Insurance Philippines 2021 Ofwmoney

How To Add A Baby To Health Insurance 6 Steps With Pictures

Travel Medical Insurance The Complete Guide Tir

How To Add A Baby To Health Insurance 6 Steps With Pictures