Health Insurance For Itin Holders

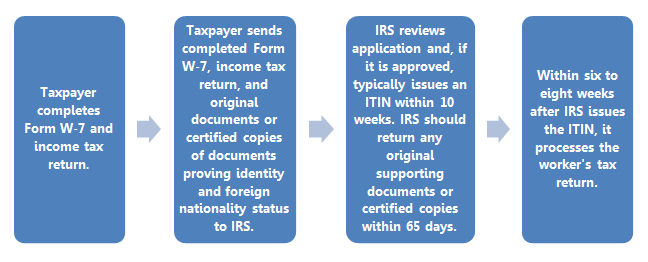

The K-1 visa is a non-immigrant visa so you should be covered under travel insurance until you get married and apply for Adjustment of Status. The process for renewing an ITIN is the same as the process for applying for a new ITIN.

Ultimate Guide To Selling International Health Insurance

Alien lawfully present in the United States.

Health insurance for itin holders. Short coverage gap of 3 consecutive months or less. At Immigrant Life Insurance we think all immigrants in the United States deserve life insurance protection. Individuals who file joint returns must provide valid Social Security numbers for both spouses in order to qualify for stimulus payments unless one spouse is in the.

You may be able to use your Individual Taxpayer Identification Number ITIN to apply for health insurance in place of the SSN. The Alien Emergency Medical AEM Program is coverage for individuals who do not meet citizenship or immigration status requirements or for qualified individuals who have not met the 5-year immigration bar and have a qualifying medical condition. The Instructions for Form 8962 state.

You can get healthcare using the marketplace from Healthcaregov however you can only use the Government marketplace after you apply for Adjustment of Status to LPR. Immigration does not qualify for sign up through the Special Enrollment Period and the employers of these immigrants spouses are not allowed to add their fiancée to. Youll find information on rules and options for immigrants on these pages.

Persons fleeing persecution including refugees and asylees. Can I add my immigrant spouse to my health insurance. Immigrants who are qualified non-citizens are generally eligible for coverage through Medicaid and the Childrens Health Insurance Program CHIP if they meet their states income and residency rules.

All we do every day is help people who have immigrated to the United. New immigrants can obtain health insurance from a variety of sources including employer-sponsored plans the individual market and health plans that are marketed specifically for immigrants. Under the Affordable Care Act most immigrants qualify for health coverage including the following groups.

The SSN ATIN or ITIN is optional if you were not required to obtain an SSN ATIN or ITIN. At Immigrant Life Insurance we have the knowledge experience and access to insurance companies that will issue policies to immigrants with an ITIN Individual Taxpayer Identification Number green card or social security card. The IRS requires that an insurance company obtain the SSN or ITIN of any policy owner who may receive an insurance benefit payment.

If a taxpayer has an ITIN instead of a SSN does health insurance coverage have to be reported under the Affordable Care Act. Before you can apply for health insurance it might help to understand how healthcare reform can work for you. It looks like they are exempt based on interpretation of the law by the National Immigration Law Center.

To be eligible individuals must. Most Immigrants Qualify for Health Coverage. The fields in Part III are validated by the schema for completeness.

Yes this will need to be reported under the Affordable Care Act. However only US citizens and immigrants with permanent residents or green cards can sign up for health insurance. You may not be able to obtain health insurance off the exchange but you will with some of the carriers we work with.

Immigrant families have important details to consider in the Health Insurance Marketplace. An ITIN doesnt look at immigration status. Lawful permanent residents or green card holders.

It simply provides a way for you to pay your taxes. The exemption would be on 8962 and be a Code C. Immigrants and Medicaid CHIP.

Under the provisions of the 2 trillion Coronavirus Aid Relief and Economic Security CARES Act signed into law on March 27 2020 ITIN holders are not eligible to receive stimulus payments even if they filed their 2019 federal tax returns. This is the list of Insurer that will accept ITIN for at least Term Life - New York Life Insurance - Primerica - Manhattan Life Family Life Insurance Company - Life Insurance Non Citizens - Immigrant Life Insurance I hope had help you. Health coverage is considered unaffordable exceeded 824 of household income for the 2020 taxable year Families self-only coverage combined cost is unaffordable.

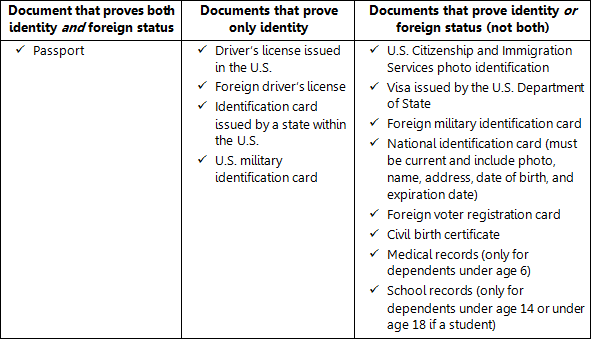

Applicants are required to submit identity and foreign nationality status documents see What documents must a person present when applying for an ITIN above and proof of US. If the SSN ATIN or ITIN is present it does not have to match the SSN ATIN or ITIN listed on page 1 of the Form 1040 1040A or 1040EZ. Residency must be included for applicants claimed as dependents.

Most insurance plans are focused more on your current residence than your SSN. Yes an ITIN Individual Taxpayer Identification Number issued by the US Department of Treasury Internal Revenue Service IRScan be used in place of the social security number SSN on any insurance application. Certain non-citizens who are not lawfully present.

According to the IRS ACA webinar today ITIN DO NOT need to have the ACA insurance etc. Most people in the following groups are eligible for coverage through the Health Insurance Marketplace. Hi Mary You will need to contact your employer to see if you can add your husband to your plan.

The Affordable Care Act has made numerous changes to our health insurance system over the last several years. If you have an ITIN you can get health insurance with most carriers. On 1222015 at 708 AM Chowdahead said.

Find out if you qualify. However if your employer allows you to add him we will be able to do so with his ITIN.

Life Insurance Without A Social Security Number Diabetes 365

Individual Taxpayer Identification Number National Immigration Law Center

Individual Taxpayer Identification Number National Immigration Law Center

Can I Get Health Insurance Without A Social Security Number Iquotenow